Welcome to the Knight Frank Active Capital Survey 2026

20 January 2026

Five key stats:

- $144 billion of commercial real estate investment identified for 2026

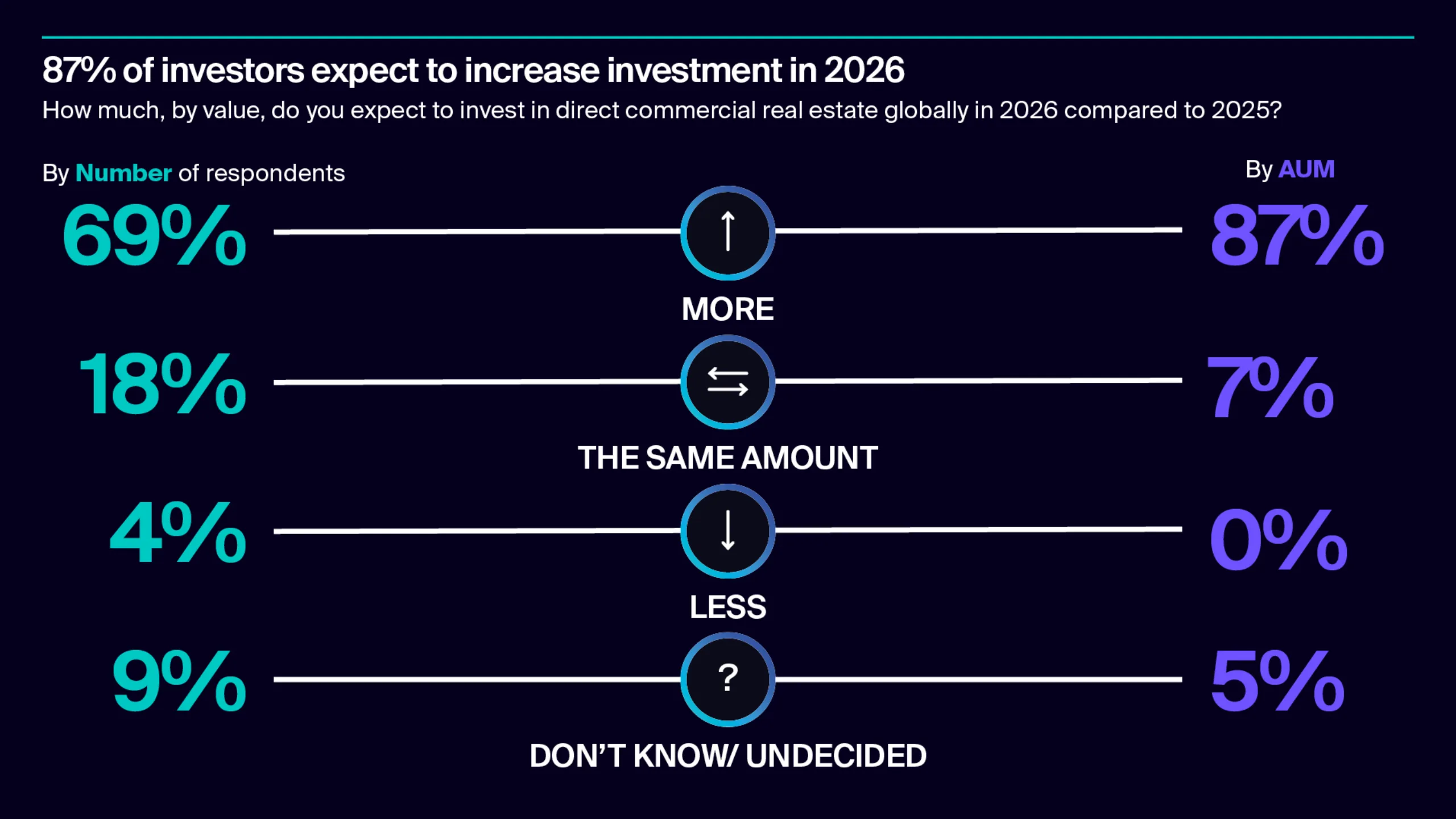

- 87% of investors by AUM looking to increase commercial real estate investment this year

- 68% of allocated investment capital is seeking joint-venture opportunities

- Core capital set to return with $37 billion targeted at Core opportunities

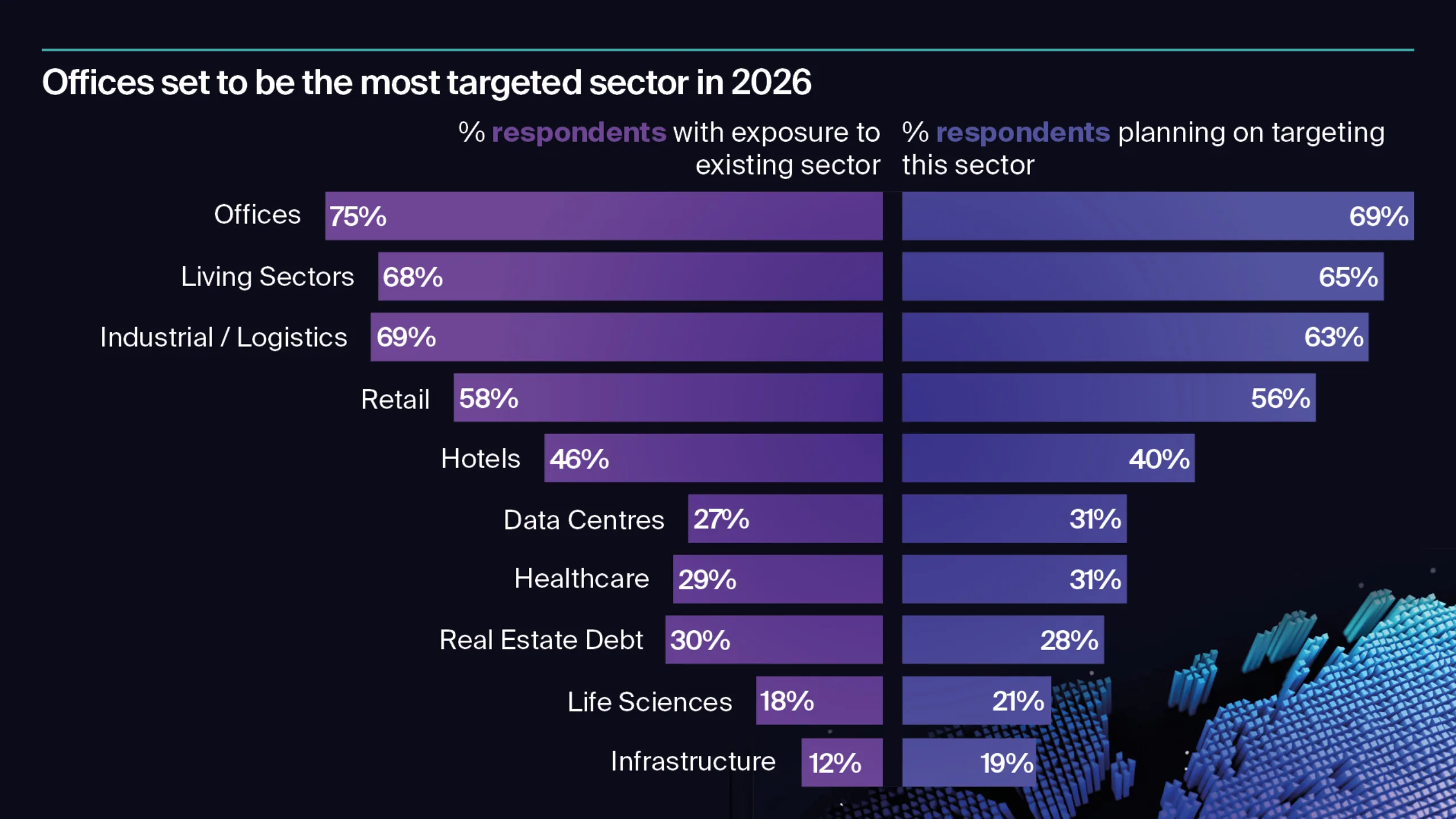

- Offices, residential and Industrial / logistics are the top three targeted sectors for 2026

The balance shifts

The global commercial real estate market is entering 2026 with renewed confidence. As this edition of Active Capital – Noise, Nuance and Opportunity – reveals, investor sentiment is shifting from caution to conviction following several years of higher interest rates, pricing uncertainty and constrained liquidity.

Underpinning the headline conclusions are the results of the Knight Frank Active Capital Survey. These capture the views of 119 global investors with over US$1.4 trillion of assets under management and $144 billion of planned deployment in 2026.

Illustrating the improvement in confidence, almost 90% of survey respondents by assets under management plan to increase their investment in commercial real estate in 2026.

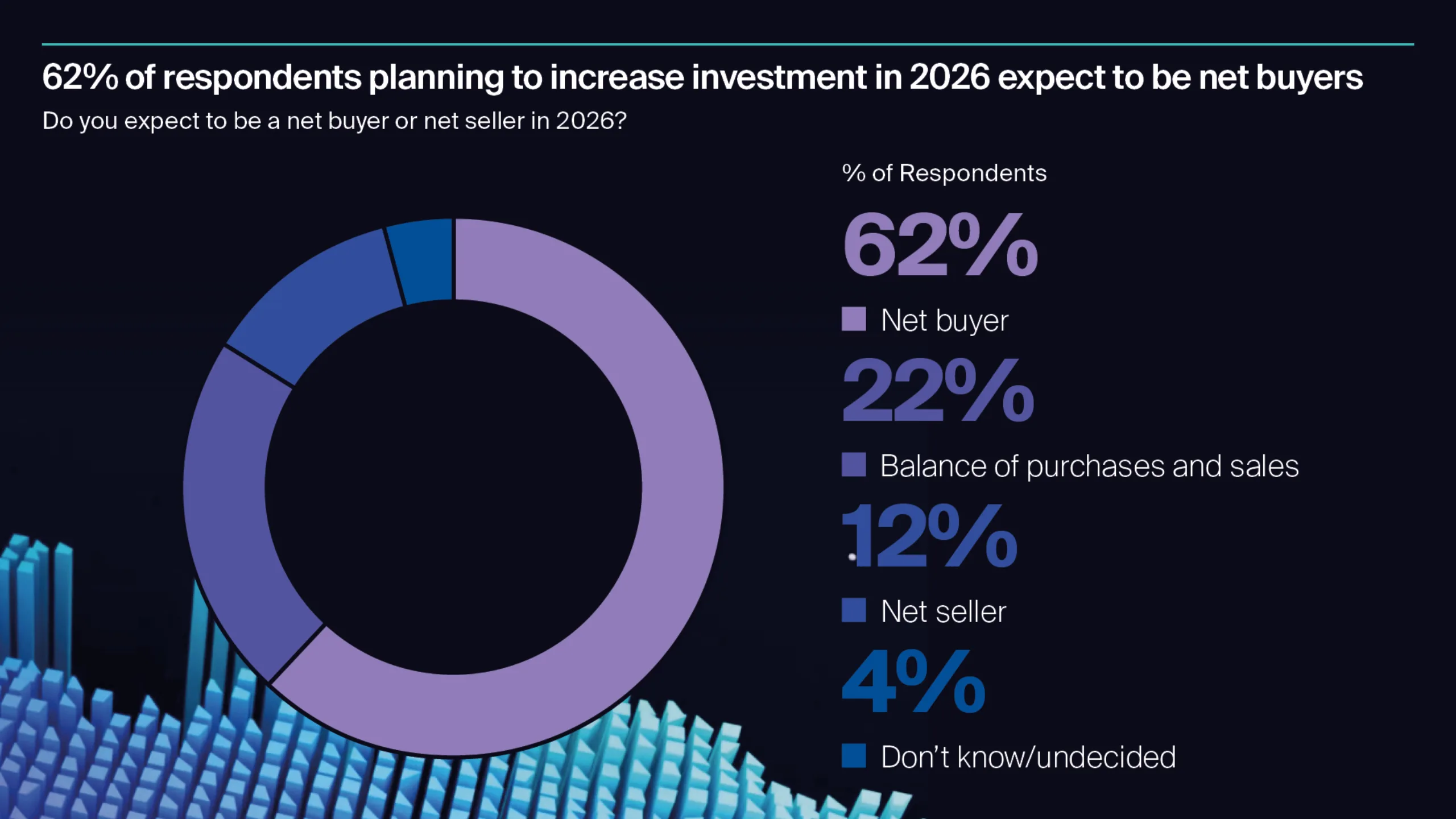

But with only 12% expecting to be net sellers, there will be a potential imbalance between capital seeking deployment and stock availability, particularly in transparent and liquid markets where pricing signals have already stabilised.

Liquidity and transparency key

For investors, the challenge in 2026 will not be a shortage of capital, but how quickly and selectively it can be deployed before competition intensifies. Geographically, investors are converging on markets where liquidity, transparency and repricing have aligned.

According to our survey, the UK ranks as the top global destination with 60% of respondents planning to make investments there this year. Narrowing bid-ask spreads, deep capital markets and early-cycle opportunities help explain the attraction.

Germany follows closely, reinforcing its role as a core European gateway market, with France, Spain and the Netherlands also attracting strong interest. In the Asia-Pacific region, low debt costs and structural demand drivers will help lure investors to Japan, Singapore and Australia.

Capital is becoming more selective, concentrating in locations where confidence in values, liquidity and exit prospects is highest. In terms of target sectors, there has been a notable rebalancing.

Offices top target

Offices have returned as the top investment target, with 69% of survey respondents planning allocations. But investors are increasingly differentiating between well-located, ESG-compliant assets that can meet modern occupier demands and those facing long-term obsolescence.

Industrial and logistics remains a high-conviction sector, targeted by 63% of investors. Its appeal continues to be underpinned by supply-chain resilience, steady e-commerce penetration in certain markets and its growing strategic importance for national and economic security.

Retail, out of favour for a while, is also seeing a measured resurgence, with over half of respondents planning to allocate capital, typically with a focus on income resilience and repriced opportunities rather than structural turnaround stories.

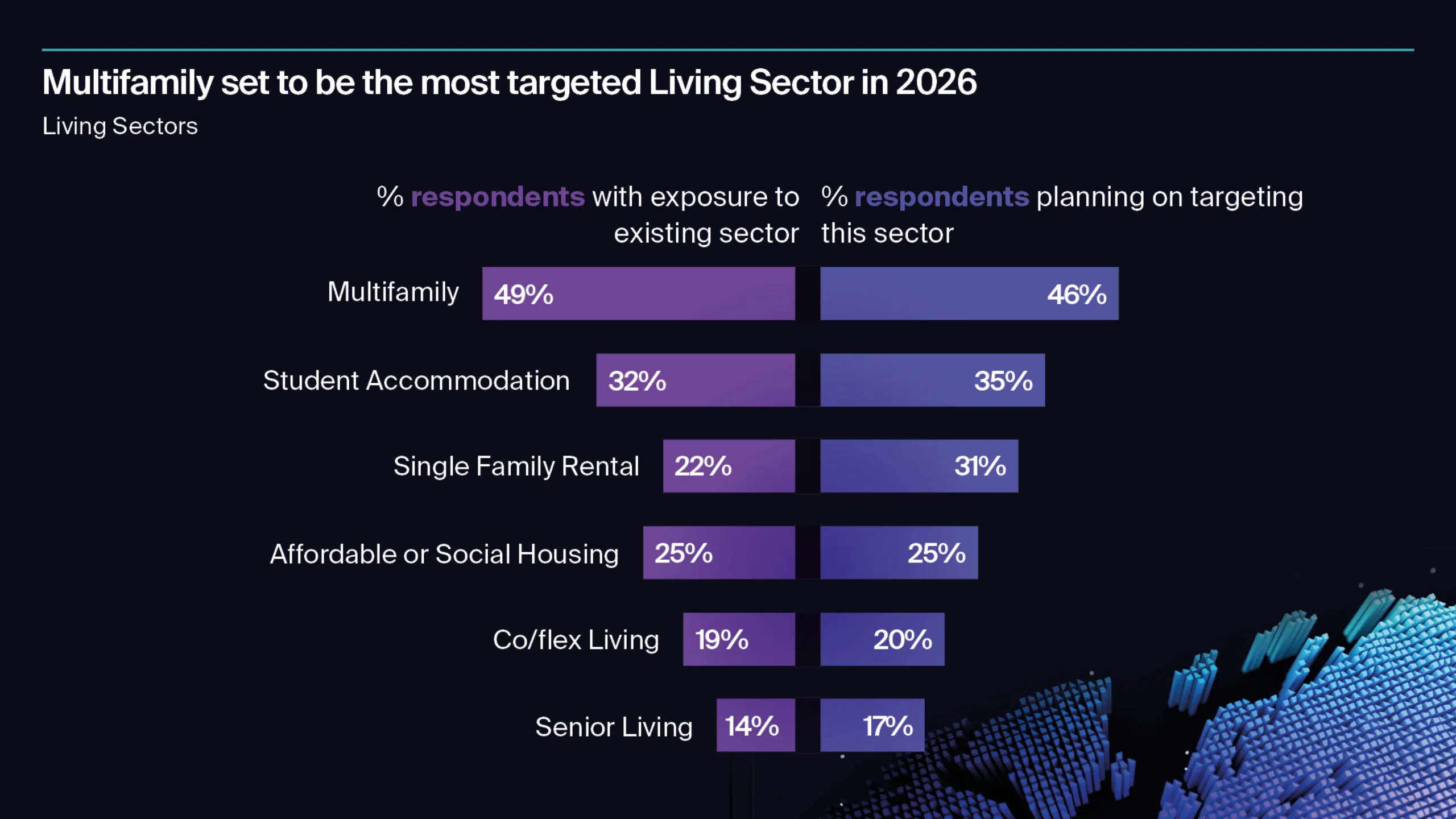

Alongside these traditional sectors, diversification is accelerating. Living sectors, including multifamily, student accommodation and single-family rental, continue to attract capital supported by demographic tailwinds and demand for defensive income.

Operational assets gaining momentum

Operational and alternative sectors such as healthcare, data centres, infrastructure and life sciences are also gaining traction. Allocations are often modest, generally below 10%, but their inclusion reflects longer-term structural themes shaping portfolio construction.

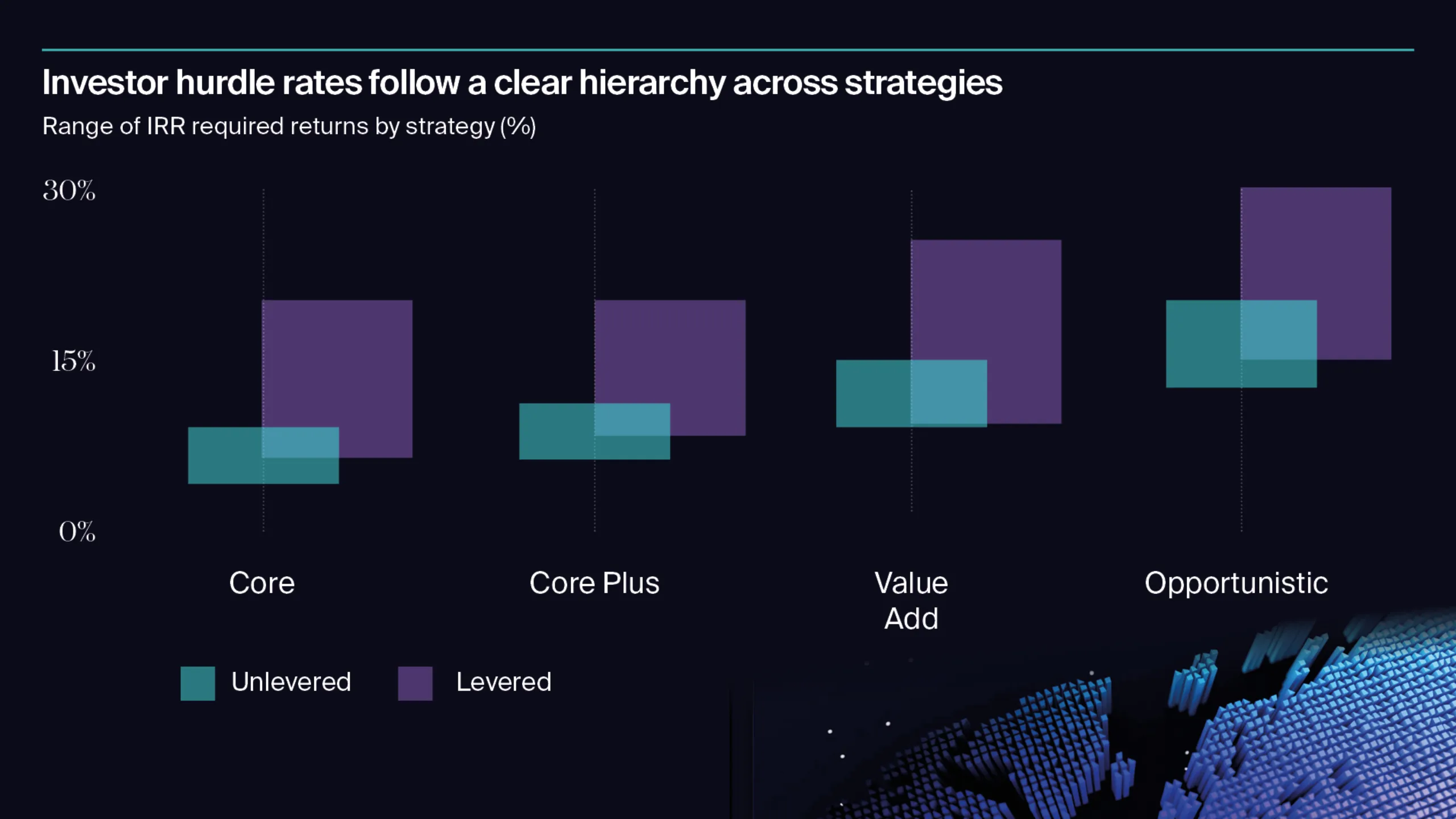

Strategy allocations underline a market seeking balance rather than extremes. Planned deployment for 2026 is split across Core, Core Plus, Value Add and Opportunistic strategies.

Core retains its role as a portfolio stabiliser, with an average weighting of 51% among investors targeting it and approximately $37 billion of planned investment this year. As debt costs ease and bond yields moderate, Core’s competitiveness against fixed-income alternatives is improving. Interest rates are the top-rated factor driving investment decisions, significantly outranking most other themes, including geopolitical risk.

Complexity premium demands

Higher-risk strategies remain firmly on the agenda, but investors are demanding a clear premium for complexity, execution risk and repricing uncertainty. At the other end of the spectrum, core is set to return with $37bn of investment allocated by survey respondents.

Another key signal from the survey is the growing importance of collaboration. More than two-thirds of respondents plan to consider joint ventures or capital partnerships in 2026, collectively representing a $94 billion share of planned deployment.

Agility is emerging as a defining advantage. With competition set to intensify in markets where pricing clarity has returned, investors who can move quickly, structure creatively, and partner effectively are more likely to secure early-cycle opportunities. The insight from Active Capital can help give you that edge.

Sign up to receive regular Active Capital insights.

Read more

Explore the rest of our Active Capital insights.