Business rates revaluation 2026: What hotel operators need to know

The 2026 Business Rates revaluation brings permanently lower multipliers for the RHL sector, but sharp increases in rateable values mean many hotel operators will still face significantly higher liabilities. This article outlines what’s changing, how transitional relief works, and why early action matters.

17 December 2025

New Business Rates Multipliers for the RHL Sector

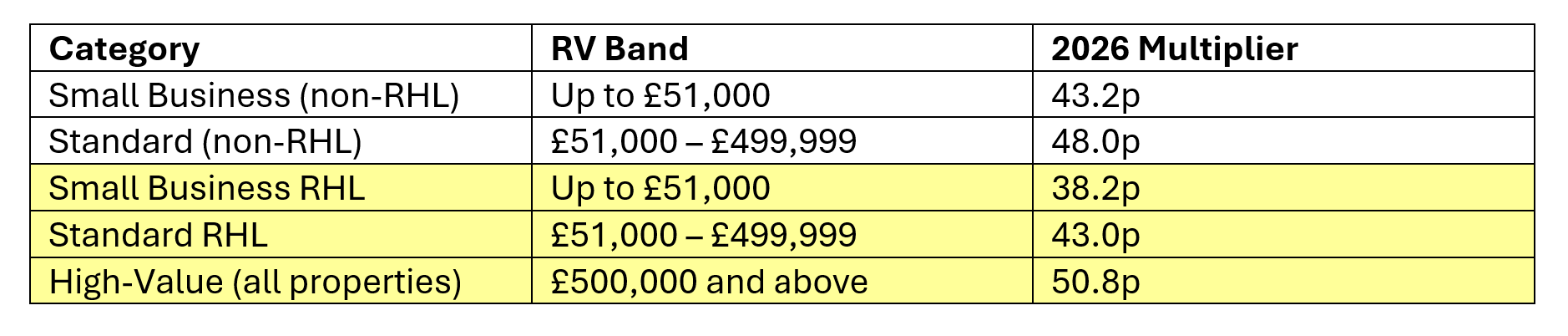

The Budget removes retail relief in favour of permanently reduced business rates multipliers for the Retail, Hospitality, and Leisure (RHL) sectors:

Key notes:

Key notes:

- Properties in London and the City of London will be subject to supplements (details TBC)

- Properties not in transition will incur a 1p supplement in 2026.

- If a property becomes vacant, once empty property relief expires it will revert to the higher non-RHL multiplier

Although multipliers are lower than current levels, many hotel assets will see significant increases in liability due to very large jumps in rateable value (RV).

Transitional Relief (2026-2029)

The £4.3 billion transitional support package limits increases, but only up to capped levels:

Key notes:

- Properties that were classified as RHL in 2023 but lose RHL status in 2026 will face much higher Year 1 caps, significantly increasing liability

- Properties that do not reach their cap will be subject to the 1p supplement, added to the relevant multiplier for 2026 only

- If a property becomes vacant, once any empty property relief expires, the liability will be recalculated using the non-RHL multiplier.

Knight Frank’s updated 2026 Business Rates Calculator will be released in the new year.

2026 Draft List: Significant increases for hotels in England and Wales

The Draft 2026 List shows a 76% average RV increase across the 93,750 hereditaments in the Hotels, Guest & Boarding, Self Catering sub-sector across England and Wales.For comparison:

- 2023 List Change (national): –27%

- 2026 List Change (national): +76%

This represents a major shock for the industry. In many cases, RVs are now set to exceed 2017 levels - despite the well-documented operational pressures of rising costs, labour shortages, and uneven post-COVID recovery.

The Draft List appears to treat short-term post-pandemic recovery as a sustained upward trend, which does not reflect the complexity or volatility of real hotel trading performance.

The increases in the 2026 Draft List for all premises falling under the Hotels Sub Sector, are shown below:

|

Breakdown of 2026 RV changes by asset type

Hotels, Guest & Boarding, Self Catering etc Sub-sector |

+76% |

|

Country House Hotels |

+22% |

|

Field Study, Activity And Adventure Centres |

+31% |

|

Guest & Boarding Houses |

+31% |

|

Holiday Centres |

+74% |

|

Holiday Homes Self Catering |

+23% |

|

Hostels |

+43% |

|

Hotels (3 Star And Under) |

+37% |

|

Hotels (4 Star And Above) & Chain Operated 3 Star |

+97% |

|

Inns |

+45% |

|

Lodges |

+122% |

|

Serviced Apartments |

+71% |

|

Timeshare Complexes |

+2% |

For any operators with large increases, there will be transitional relief to stagger those payments by 15% or 30% depending upon the size of the assessment, but many hotel operators will:

- Remain in transition until 31 March 2029.

- Move to full liability from 1 April 2029 with no further phasing.

Given the size of the increases, the effect will be long-lasting for many assets.

Why reviewing the 2023 List matters now

The 2023 List is open for challenge of the values prior to 1 April 2026. Any successful reduction in 2023 RVs will have a direct impact on 2026 transitional positions, potentially mitigating increases for up to three years ahead.

This makes early review and challenge particularly important for hotel operators.Knight Frank will be contesting both 2023 and 2026 increases, backed by market data and experience to deliver continued success and results for our clients.

For tailored advice on how the 2026 Draft List affects your assets, please contact the Knight Frank Business Rates Team at rating@knightfrank.com