Prime London Lettings Report: December 2020

Prime central London lettings index: 146.0

Prime outer London lettings index: 154.4

1 minute to read

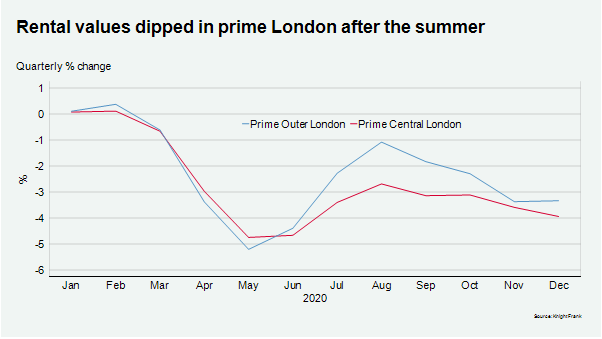

Higher levels of supply and weaker demand continued to exert downwards pressure on rental values across prime London markets in the final month of the year.

It meant that average rents finished the year down 11.9% in prime central London and 9.8% in prime outer London.

Supply has been pushed higher by a glut of short-term rental properties coming onto the long-let market due to the pandemic. Demand from international students and corporate tenants has also been weaker due to Covid-19 and associated international travel restrictions.

The impact of this supply/demand imbalance had started to weaken over the summer but tougher lockdown measures in recent months, including a second national lockdown in November, pushed rental values down for second time this year, as the below chart shows.

What is also apparent is that central London has been more impacted than outer areas including south-west London, where a stronger sales market means fewer rental properties have come onto the market. For example, the decline was 3.2% in Wimbledon and 4.2% in Hampstead during 2020.

As the Covid-19 vaccine roll-out programme gathers pace, all of these trends could reverse quite sharply in 2021, which underpins our rental value forecast for increases next year.

In the meantime, the number of tenancies being agreed remains high as tenants seek more space to work from home and take advantage of falling rents.

The number of tenancies started in the week ending 12 December was 43% higher than the five-year average.