Covid-19 Daily Dashboard - 8 October 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 8 October 2020.

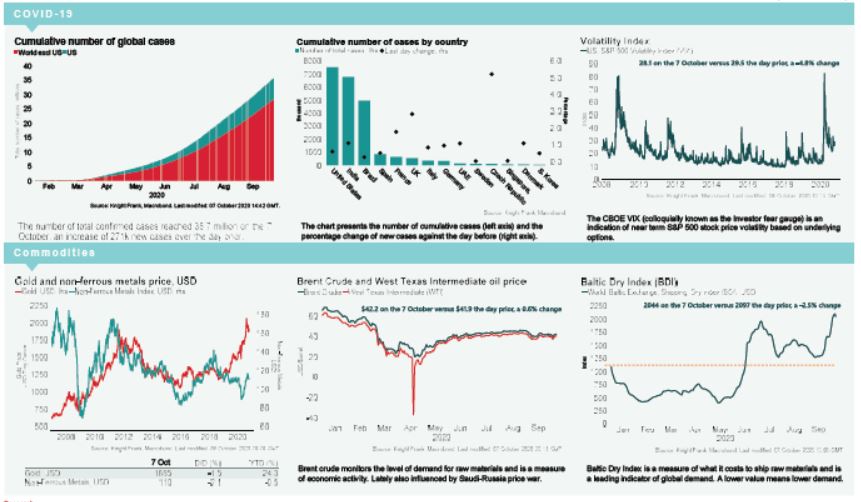

COVID-19: The total number of global recorded cases has surpassed 36 million, with circa 1.06 million reported deaths according to Johns Hopkins University & Medicine.

Equities: In Europe, stocks are mostly up this morning, with both the STOXX 600 and the DAX +0.4% higher, while the FTSE 250 (+0.3%) and the CAC 40 (+0.1%) also recorded gains. In Asia, the S&P / ASX 200 (+1.1%), Topix (+0.5%) and the Kospi (+0.2%) all closed higher, while the Hang Seng was -0.4% lower on close. In the US, futures for the S&P 500 are up +0.4%

VIX: Following a -4.8% decrease yesterday, the CBOE market volatility index has contracted a further -0.4% over the morning to 28.0. The Euro Stoxx 50 vix has also declined, down -2.5% to 24.4. These figures compare to long term averages of 19.9 and 23.9, respectively.

Bonds: The US 10-year treasury yield and the German 10-year bund yield have both compressed -2bps to 0.77% and -0.51%, while the UK 10-year gilt yield is down -1bp to 0.29%. The spread between the German 10-year bund and the US treasury yield is currently 128bps, the widest it has been since March.

Currency: Sterling is currently $1.30, while the euro is $1.18. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.35% and 1.20% per annum on a five-year basis.

Oil: The West Texas Intermediate (WTI) has risen back above $40 per barrel this morning after increasing +1.0% to $40.33. Brent Crude is also up +1.0% this morning, to $42.42.

Baltic Dry: The Baltic Dry decreased for the first time in seven sessions, down -2.5% yesterday to 2,044. Over the last seven sessions, the index has increased a cumulative +19%.

Gold: The price of gold increased +0.4% yesterday to $1,885 per troy ounce.

Easyjet: The airline has reported it will be flying at 25% of last years capacity in the final quarter of 2020, down from just under 40% in Q2. This comes as Easyjet announced they expect to report a pre-tax loss of between £815 million and £845 million in the 12-months to September 2020, the first annual loss in the airline’s 25-year history.