Asia-Pacific shines as an offshoring hub amid global economic challenges

Global companies increasingly seek cost-effective solutions to minimise expenses, and a growing number are now looking towards offshoring functions in Asia-Pacific as a strategic avenue.

3 minutes to read

This is one of the key findings of Knight Frank's Asia-Pacific Horizon: Harnessing the Potential of Offshoring. The report studies the essential factors that define the region's appeal as the best location for offshore services and sheds light on the significant changes in the industry.

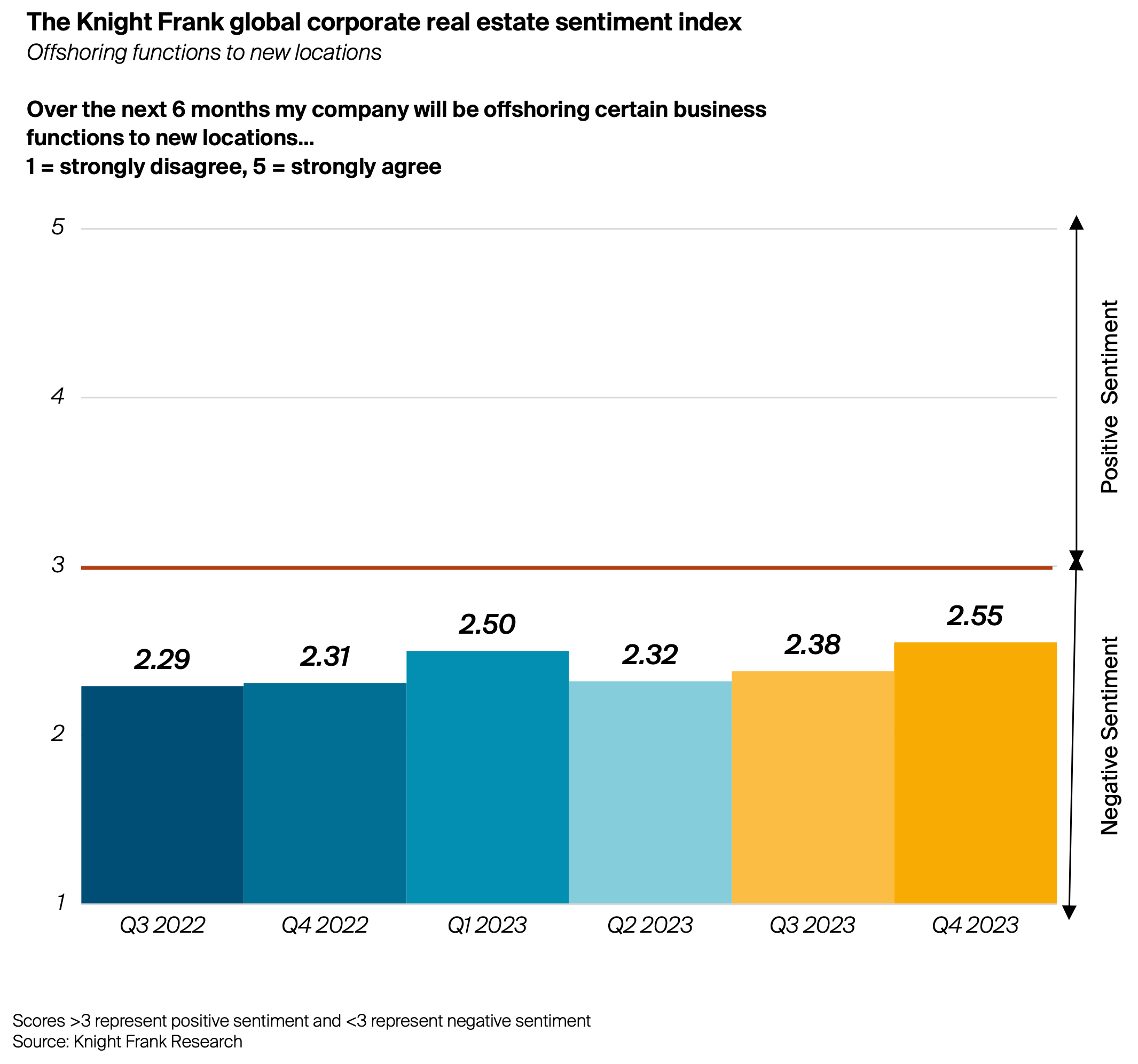

Results from the Q4 2023 Knight Frank Global Corporate Real Estate Sentiment Index survey underscore this trajectory, indicating a growing trend towards offshoring activities and suggesting that more businesses may turn to this strategy to manage costs from 2024 onwards. The index assesses corporate real estate leaders' near-term (six-month) outlook, encompassing growth, portfolio, and workplace dynamics.

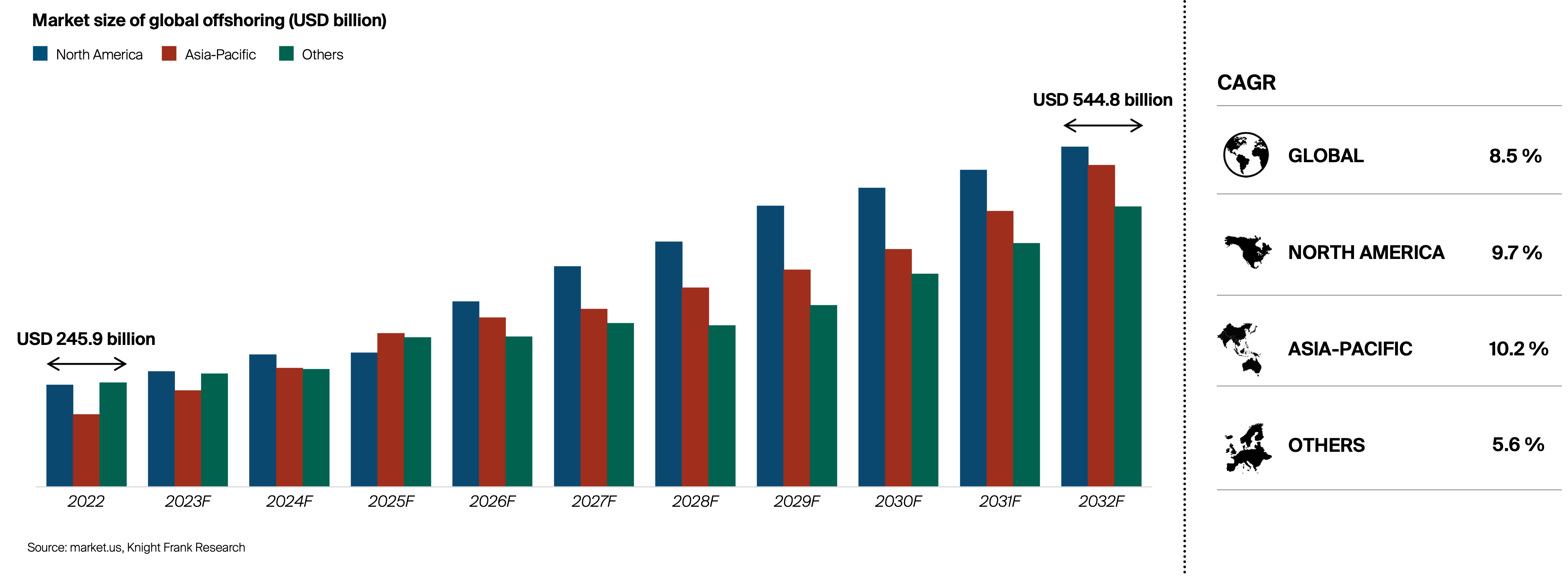

Projections indicate that the global offshoring market is predicted to grow from USD 245.9 billion in 2022 to USD 544.8 billion in 2032, reflecting an 8.5% compound annual growth rate (CAGR). While North America will continue to retain market dominance, Asia-Pacific is expected to record the most pronounced CAGR at 10.2%. Another study done by Spherical Insights showed that the Asia-Pacific market size was valued at USD 72.7 billion in 2022 and is forecast to more than double to USD 185.1 billion by 2032.

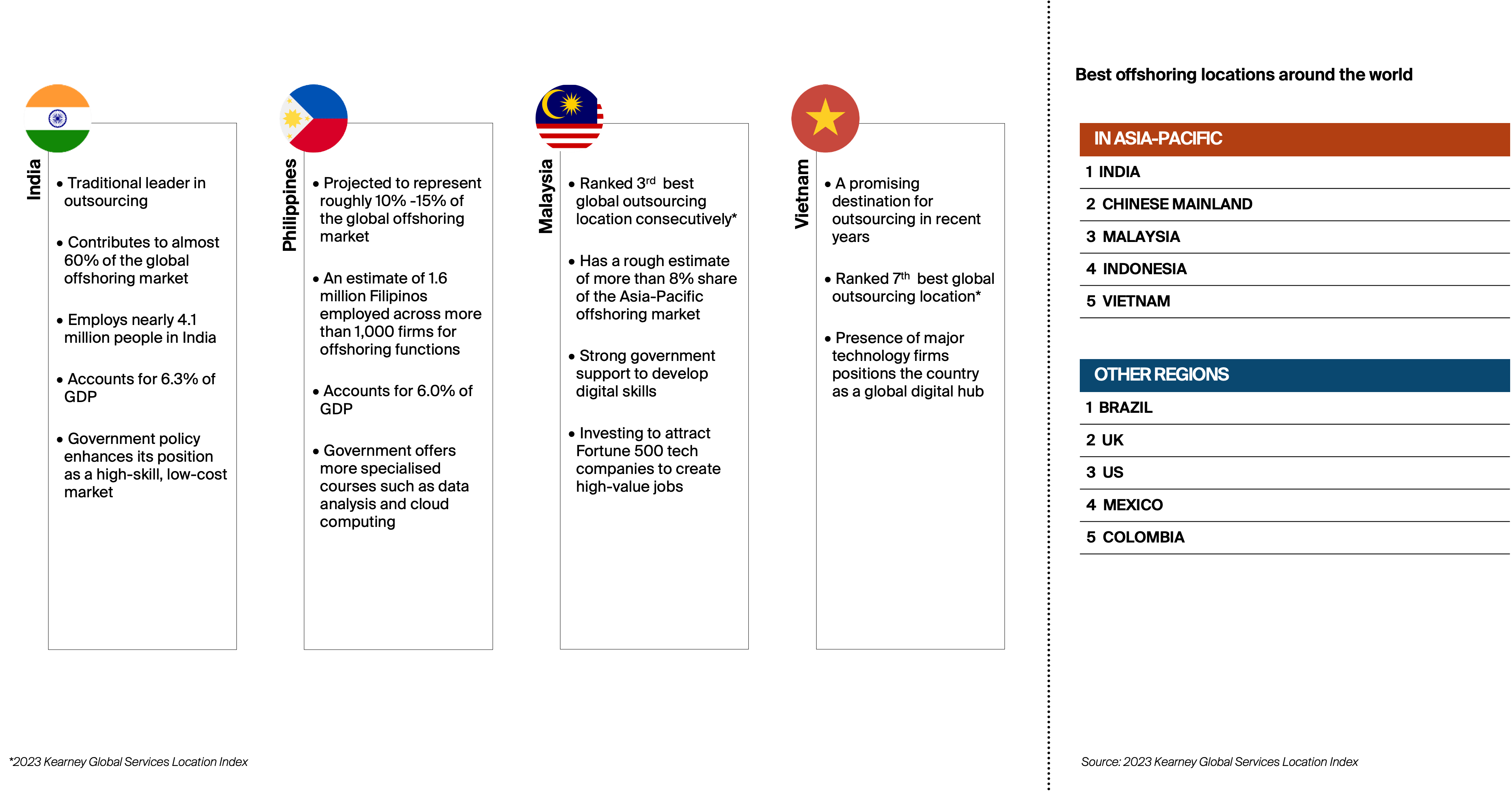

Leveraging its unique advantages, the Asia-Pacific offshoring market has witnessed significant expansion, with growth expected to accelerate beyond 2023. Key factors contributing to this trend include rising labour costs, an increased demand for skilled workers, and the ongoing digital investments made by market participants. These elements have not only strengthened the region's position as a global offshoring hub but also paved the way for select markets to emerge as world-renowned offshoring centres.

As the offshoring industry continues to evolve, the Asia-Pacific region remains at the forefront of this transformation, offering businesses a multitude of opportunities and innovative solutions to thrive in the global market.

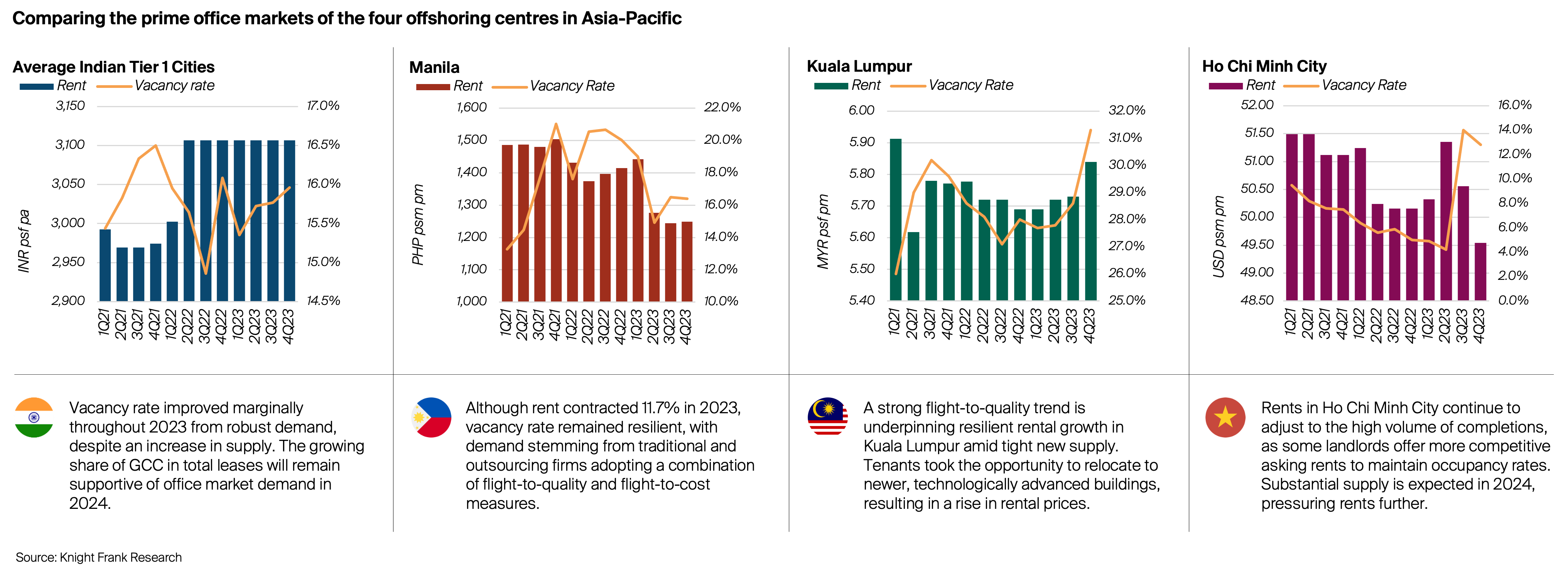

Drawing from the Knight Frank Asia-Pacific Q4 2023 Office Highlights, the region experienced a 2.4% decline in overall rents, alongside an upward trend in the average vacancy rate, which increased by 1.24% for 2023. While sentiment shows signs of improvement, it remains fragile, with occupiers continuing to exercise caution in response to the challenging macroeconomic environment. Many corporations are facing constraints in capital expenditure (CAPEX) and expansion plans, including within the four markets mentioned with flourishing offshoring demand.

In spite of the challenges, corporate occupiers are increasingly prioritising offshoring functions as a strategic avenue for achieving growth and innovation at a lower cost without compromising efficiency in higher-cost locations. This approach enables businesses to balance cost optimisation and performance, driving headcount growth in cost-effective regions while strengthening office demand in strategic locations.

Strategic resource allocation has played a crucial role in mitigating rental declines in markets such as Vietnam and the Philippines. Despite higher vacancies, rents have strengthened in Malaysia and India, highlighting the importance of adaptive measures in response to market fluctuations.

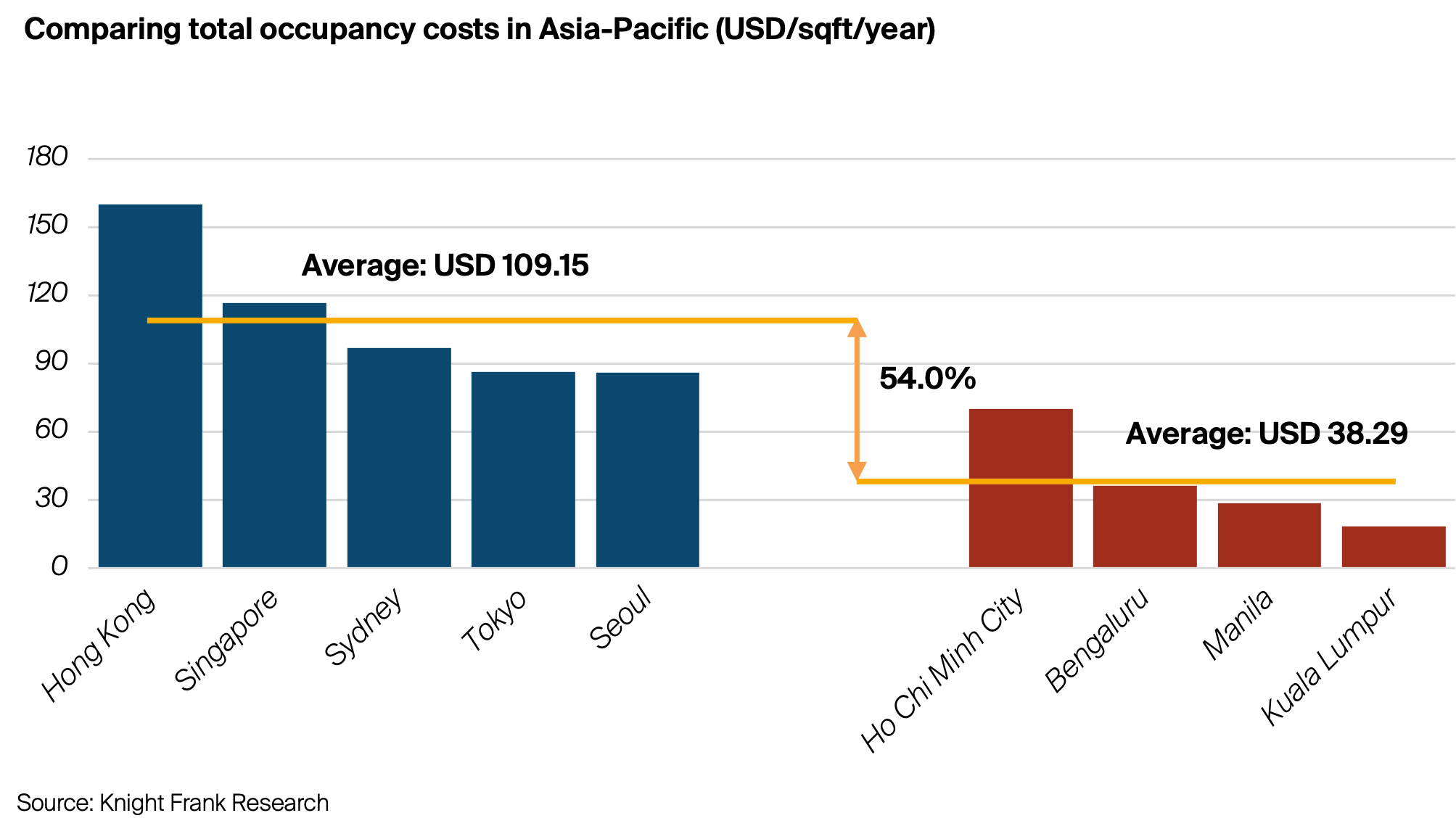

The competitive real estate costs within the Asia-Pacific offshoring market present a strong incentive for businesses to pursue consistent offshoring activities. The potential for significant cost savings is evident, with occupiers standing to save an average of USD 70.86 per square foot of office space in the four key markets compared to mature markets. This substantial reduction amounts to a remarkable 54% decrease in annual occupancy costs.

Consequently, these cost advantages are expected to fuel further the growth of the offshoring industry in the region as businesses seek to optimise expenses and maintain a competitive edge in the global market.