The recession is probably over: what next?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

UK GDP expanded 0.2% in January, the ONS said this morning. That puts the economy on course to exit the technical recession of the final months of 2023.

While that's positive, we're really talking about a series of relatively small economic expansions and contractions that add up to an almost flatlining economy with a long-running productivity problem. The Office for Budget Responsibility expects a meagre annual expansion of 0.8% in 2024 before growth picks up to 1.9% in 2025.

The unemployment rate rose to 3.9% during the three months through January, the ONS said in a separate release yesterday. Wages are also cooling. The data should feed relatively quickly into what will be a crucial couple of months of inflation figures. Inflation expectations continue to cool.

The number of people classed as "economically inactive" that picked up during the pandemic has continued to rise. A total of 9.25 million people of working age are now classed as economically inactive, up from 8.55 million at the outset of the pandemic. Liz McKeown, director of economic statistics at the Office for National Statistics, told Radio 4 there had been a particularly steep rise in under-25s staying out of the workforce, despite vacancies running at more than 900,000.

Mortgage lending

Bank of England figures published yesterday also showed more signs of economic strain. The value of new mortgage commitments (funds that banks have agreed to lend over the coming months) fell 6.6% in Q4 compared to the previous quarter to £46 billion. That's more than a fifth lower than a year earlier and is the lowest amount since 2013 if you exclude the pandemic. These figures should pick up over the coming months.

Mortgage arrears rose 9.2% on a quarterly basis and 50% compared to Q4 2022. The total value of mortgage balances which had some arrears increased to £20.3bn, or 1.23% – the highest since the fourth quarter of 2016.

“At 1.23%, the proportion of loan balances in arrears is still very low, but the pace at which it is rising will be a source of concern for policymakers at the Bank of England," Simon Gammon of Knight Frank Finance tells the Guardian. “While borrowing costs have likely peaked and should begin falling meaningfully over the summer, the figures demonstrate that we’re not yet out of the woods and conditions remain very difficult for many borrowers.”

The mortgage market is volatile - margins are thin, forcing lenders to react quickly to moves in swap rates. The average shelf-life of a mortgage product is running at a six-month low of 15 days, according to data from Moneyfacts.

Prime central London

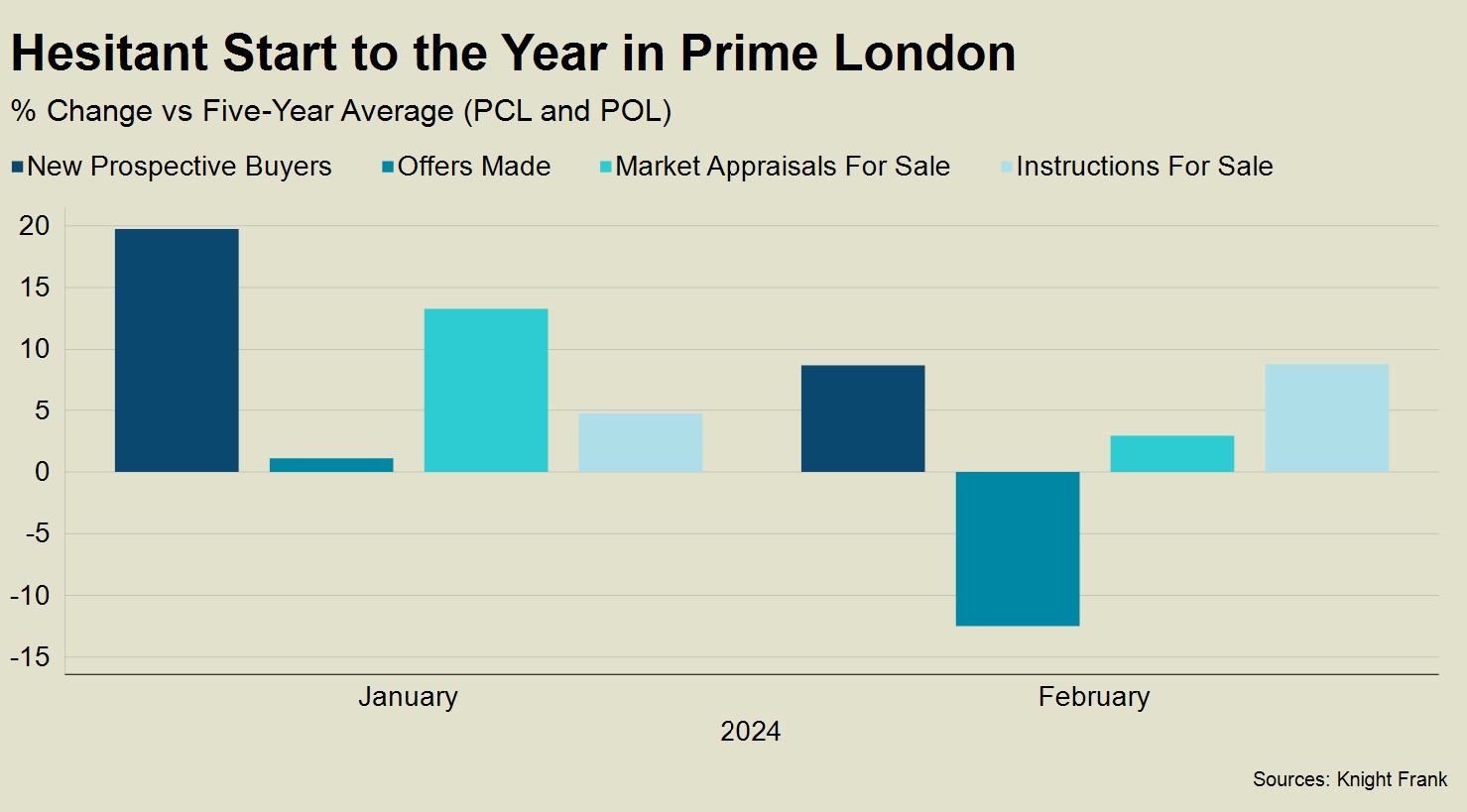

The murkier outlook for inflation and borrowing costs, the increasingly heated countdown to the general election, overseas military conflicts and now a budget that will result in the abolition of the non-dom tax regime led to a hesitant start to the year in the prime central London sales market (see chart).

The average annual price fall in prime central London (PCL) was -2.4% in February while the comparable figure in prime outer London (POL) was -1.6%.

On the demand side, the number of new prospective buyers was 9% higher than the five-year average in February, according to Knight Frank data adjusted for leap years. That was lower than the equivalent rise in January and reflects the slightly gloomier mood in the second month of the year in relation to the outlook for mortgage rates.

This change was also visible in the number of offers made, which is a good measure for buyer sentiment. While the number was up by 1% in January versus the five-year average, there was a 12% decline in February. See the update from Tom Bill for more.

Supply builds

Seasonality is returning to the prime London lettings market after three tumultuous years.

The pandemic meant the market was initially flooded with stock in 2020 as short-lets were banned under Covid rules. Then, once the sales market ignited due to a stamp duty holiday and the ‘race for space’, it prompted more landlords to leave the sector because of the growing regulatory and tax burden.

Now, as supply gradually rebuilds and demand cools, it has pushed rental value growth down in recent months. Average rents in prime central London rose 6.3% in the year to February, which is a threefold decrease from the 18% recorded in the same month last year. There's more from Tom here.

In other news...

The latest IPF Consensus forecast highlights improved expectations for UK commercial property performance in 2024, 2025, and 2026. The total return forecast for UK All Property in 2024 improved by 90bps to +5.9% in February. The upward revision was driven by a more robust rental growth outlook of +2.0% y/y and a slight increase in anticipated capital value growth (+0.8%). You can read more in the latest Leading Indicators from Antonia Haralambous.

Elsewhere - UK heat-pump makers look to government for certainty (FT), private equity advisers warn Labour’s plan to tax carried interest will wound City (FT), Persimmon warns of challenging year ahead (Times), and finally, a second month of sticky US inflation (FT).