Pick-up in new homes demand in early 2023

Plus, have we reached peak build cost inflation?

3 minutes to read

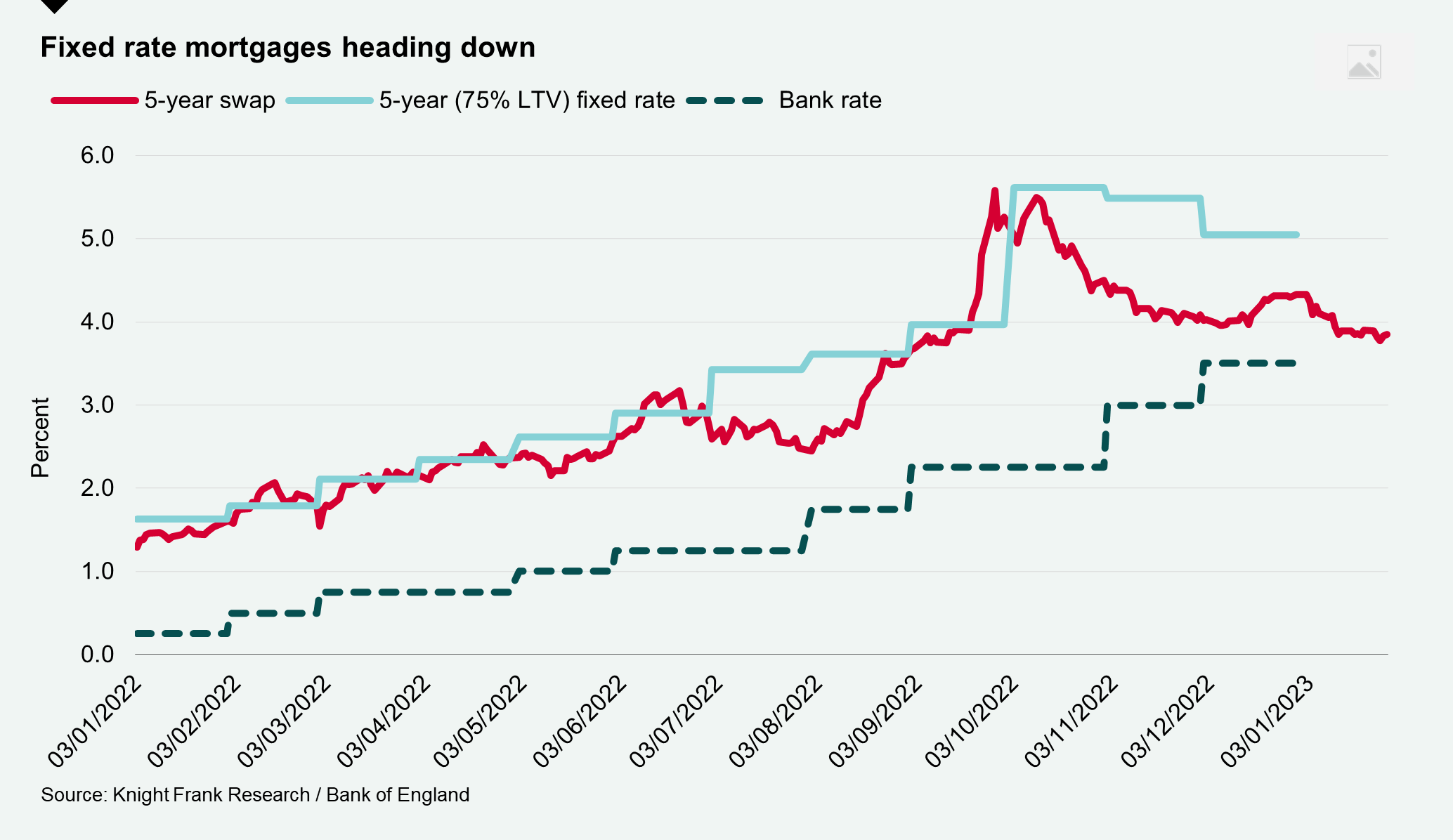

We know the story by now. Rapid increases in mortgage rates following the mini-budget, combined with inflationary pressures on household spending have resulted in reduced demand and falling house prices.

From a development perspective the end of Help to Buy and ongoing high build and financing costs have added another layer of complexity (as has the uncertain planning environment). Together, this has squeezed margins, increased pressure on land values and, ultimately, led to a fall in housing delivery, something we explored previously.

New year new homes bounce

For now though, demand for new homes is proving resilient. Knight Frank figures show the number of prospective buyers registering their interest in purchasing a new home in January was markedly higher than both 2020 and 2021, and only just behind the number at the start of 2022.

The suggestion is that many buyers are dusting off plans that were postponed in the wake of the mini-budget. With evidence mounting that both inflation and mortgage rates have peaked, the early part of 2023 could offer a period of relative stability for buyers.

Those figures chime with the latest update from online property portal Zoopla which highlighted a robust start to the year in terms of activity. Flats, in particular, have regained their popularity with would-be buyers, which bodes well for new homes demand. Of those looking to make a move, 27% are seeking one or two-bedroom flats, up from 22% this time last year. In London, one and two-bedroom flats now account for 49% of demand, up from 42% a year ago.

Land values starting to ease

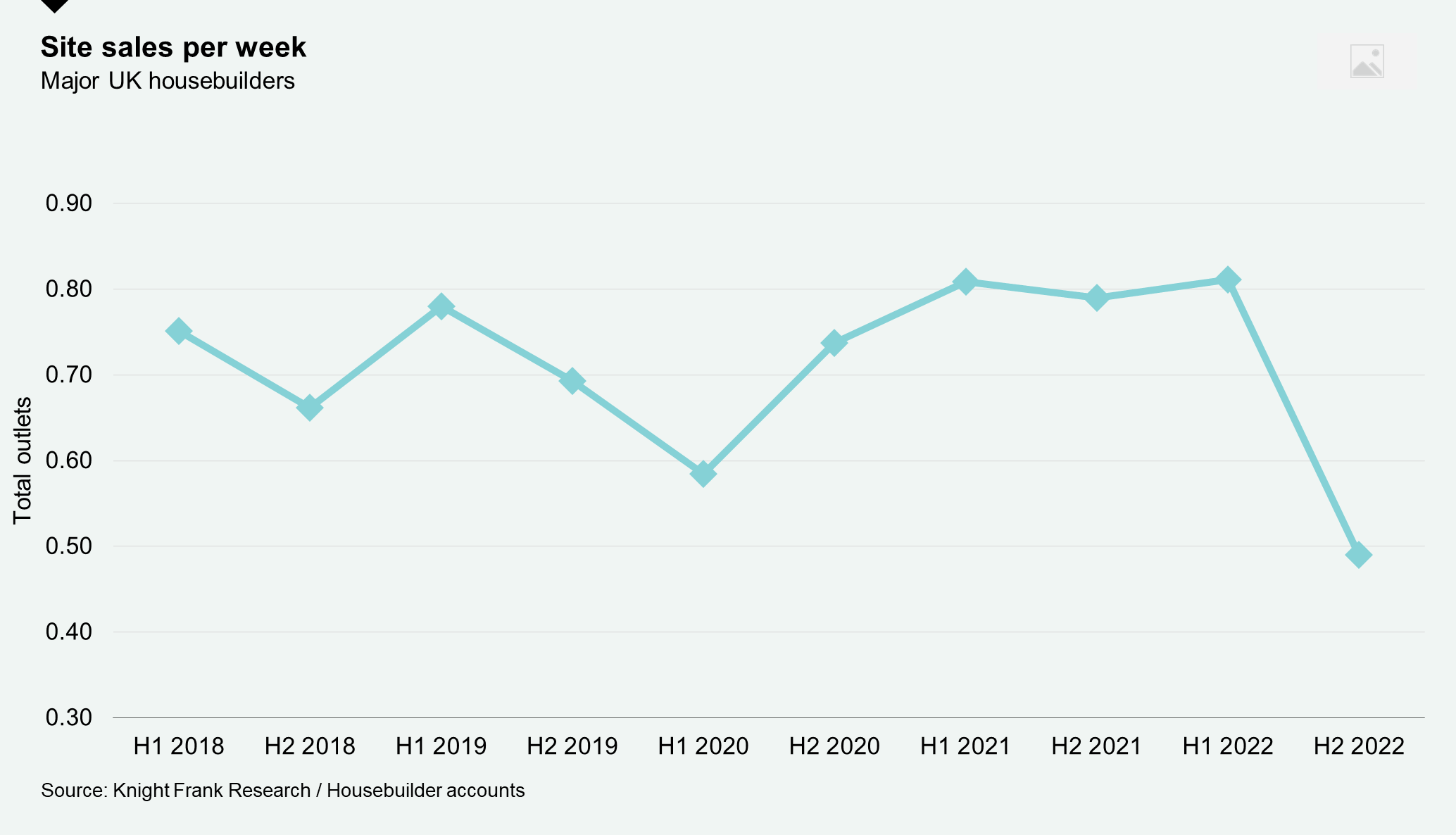

One group that will be watching the performance of the sales market in early 2023 closely are the major housebuilders. Recent trading updates all point to a notable slowdown in new home reservations in the final three months of last year (see chart below).

In turn, this has led to them becoming very selective when it comes to bidding for land. This uncertainty is reflected in our latest Residential Development Land Index figures, out later this week, which show UK greenfield and urban brownfield values falling on average by 3.5% and 8.5% in Q4 2022, taking the annual change to -1.3% and -9.2% respectively.

In prime central London an ongoing scarcity of sites for sale meant values bucked the national trend and were flat on a quarterly basis and up by 2.5% annually. Tom Bill unpicks the latest sales data for prime London here.

Have we reached peak build costs inflation?

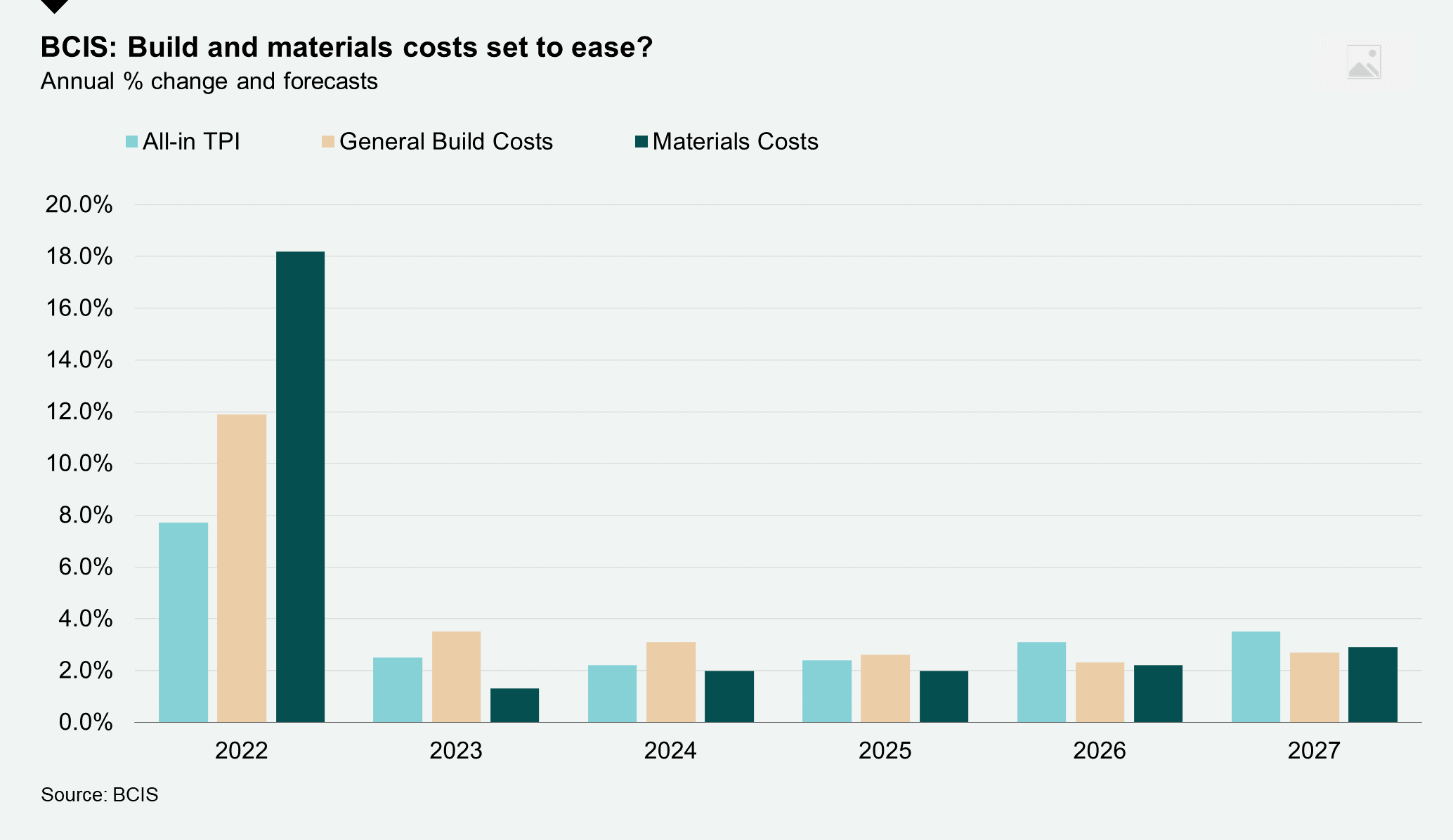

Build costs remain a big concern, though there are signs we may have passed peak inflation. Build costs increased 9.7% annually at the end of 2022, according to the BCIS General Building Cost index, down from a peak of 16.0% in June.

While inflationary pressures driven by rising energy prices remain, there are indications that the supply of construction materials is stabilising. Materials shortages were listed as the main development constraint by 30% of respondents to the 2022 Federation of Master Builders survey, down from 60% in 2021.

A drop in construction output across the board means we expect contractors will have to become more competitive as the year progresses improving viability, something which is echoed in BCIS forecasts.

Photo by Pixabay