The global economy in five charts

A snapshot of five areas, from vaccines to currencies, we are watching.

2 minutes to read

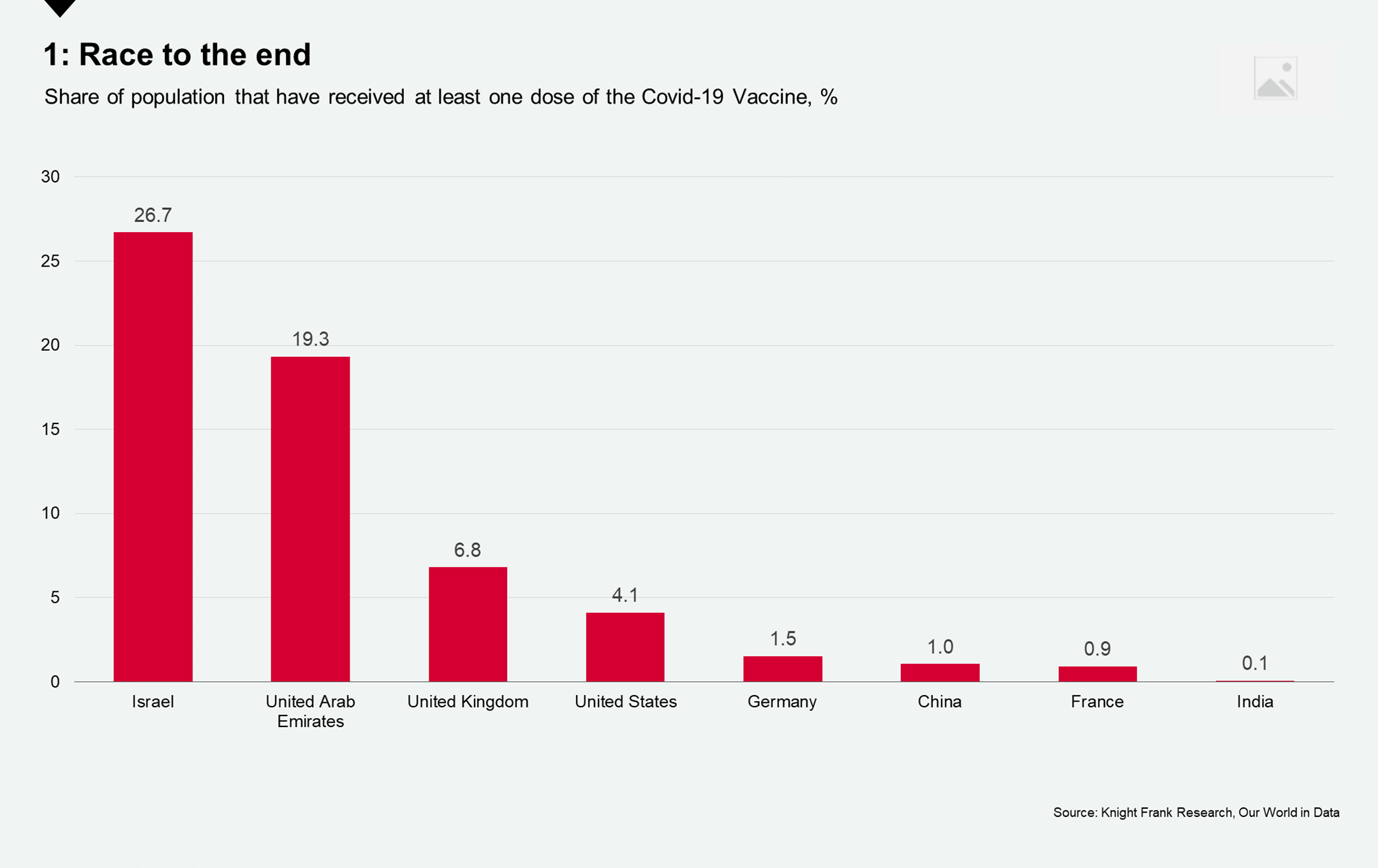

The end is in sight with over 54 million vaccines administered globally at the latest count. Israel and the UAE are leaders in proportional terms with 26.7% and 19.3% of the population having received at least one dose. The UK is leading for Europe with 6.8%. However, the UK’s Chief Scientific Adviser Sir Patrick Vallance suggested we could need 70% to reach herd immunity. Vaccines offer countries a quicker route to opening economies, but it will be some time before globally we see the return to ‘normality’.

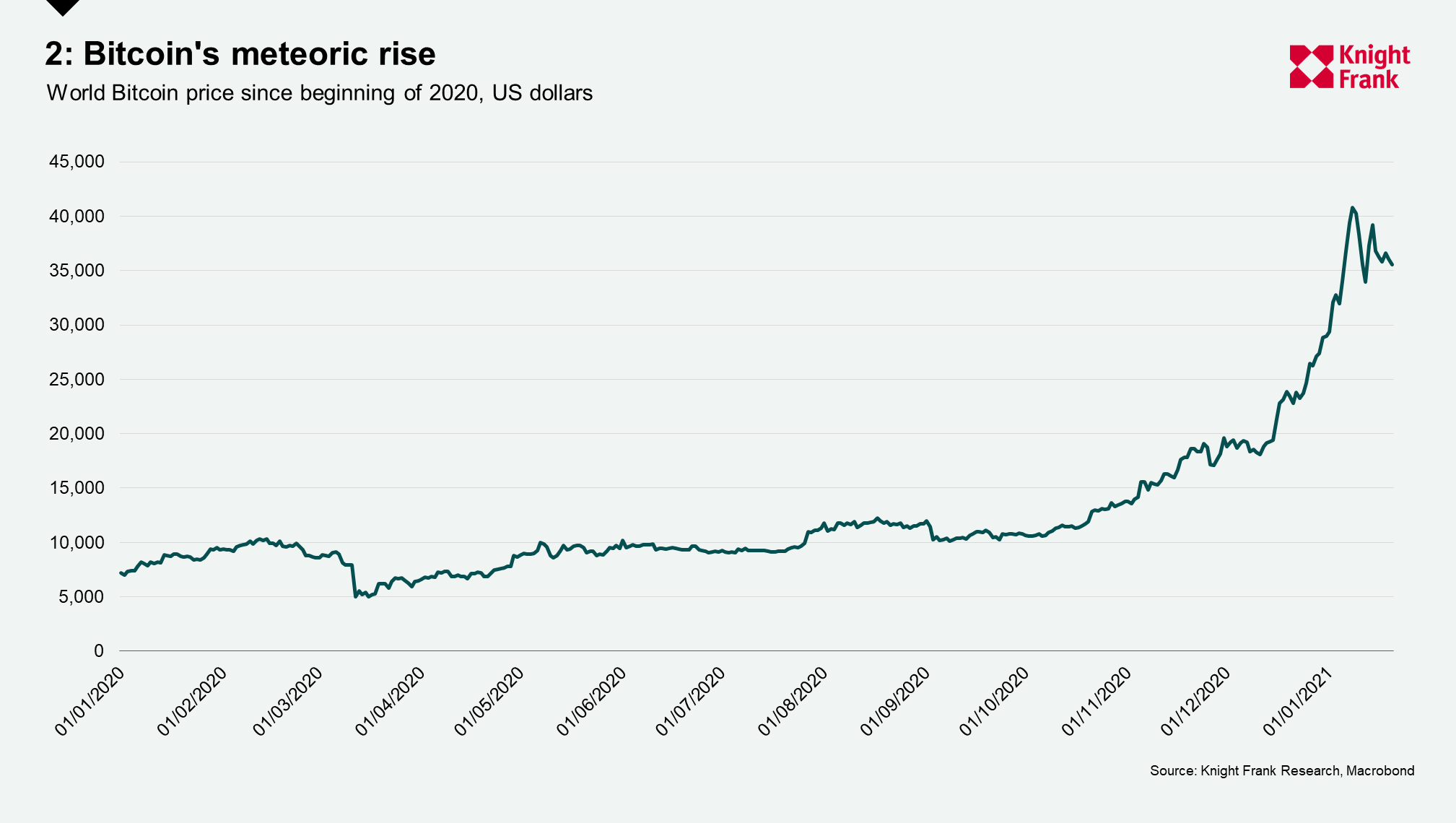

One thing dominating financial markets is Bitcoin. The most well-known cryptocurrency is renowned for its volatility but across 2020 the price rose by a staggering 400% hitting new records above $40,000 in early January 2021. Although only a small part of portfolios, cryptocurrencies accounted for 1% according to The Wealth Report 2020, Forbes wrote that the recent rally has created new billionaires. The price has since receded slightly to around $35,000 at the latest.

The US dollar has had a steady opening to 2021, gaining 1% against a basket of currencies. However, this remains 6% below that at the start of 2020 and 12% below the peak in March 2020. Whilst the currency enjoyed safe haven status throughout the tumultuous year as positivity and vaccine rollouts began the decline was more evident. The pound has risen, at time of writing, to $1.37 and the Euro sits just below $1.22 – 15% and 12% above their March 2020 levels.

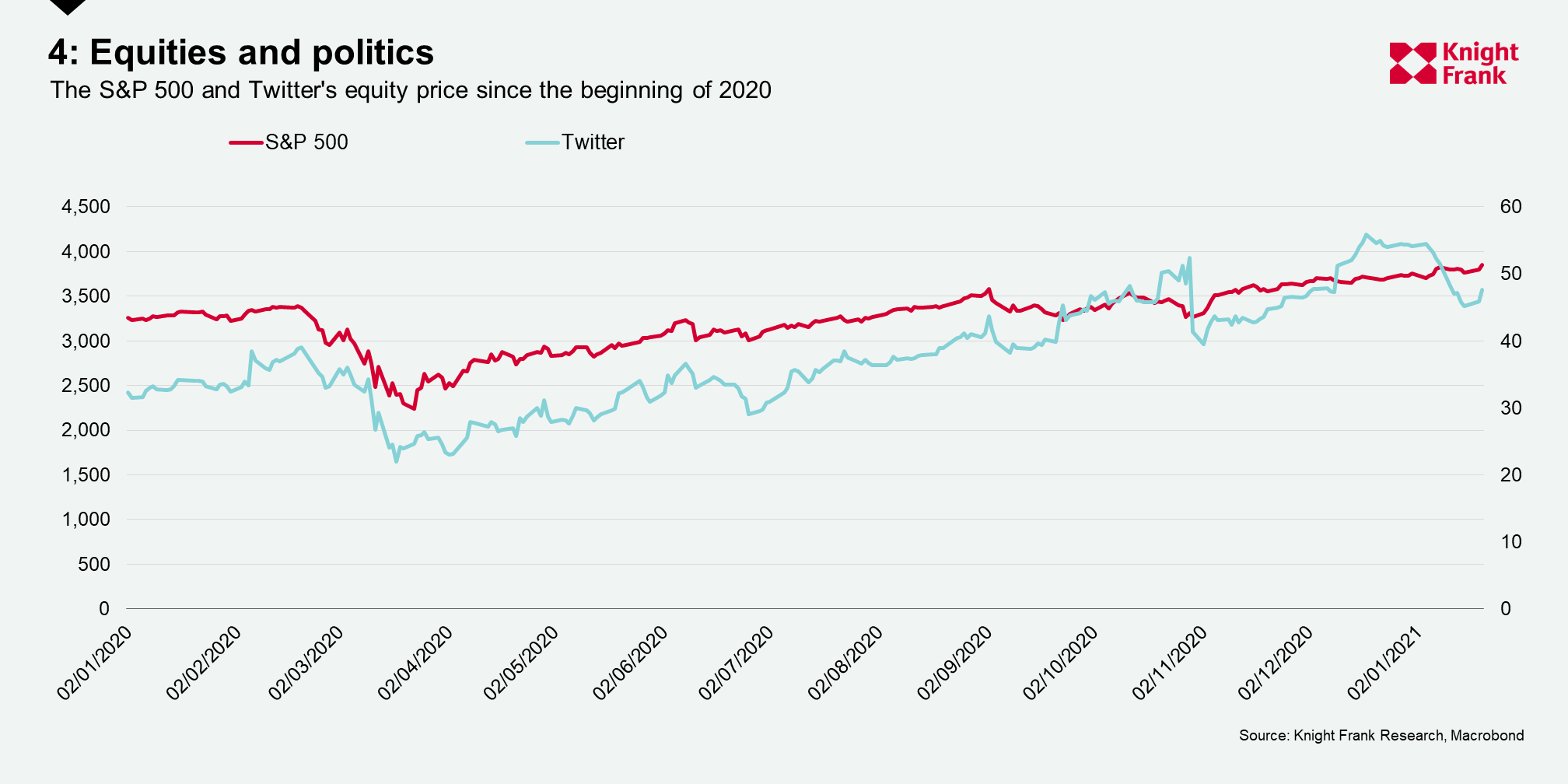

Joseph Biden officially became the 46th President of the United States on Wednesday. Since the election the S&P 500 has climbed 10% and 3% since the Democrats claimed a razor thin majority in the Senate. Twitter however has not fared so well. Since banning the then President Trump indefinitely following the riots on the US Capitol the share price has tumbled by over 10%.

One commodity that has not fully recovered or exceeded its 2020 opening is oil, although it has risen 145% from its low in March 2020. At the time of writing the price hovered around $55 per barrel, almost 8% up on the year so far.

The International Energy Agency (IEA) recently cut its forecast for oil demand in 2021 given renewed lockdowns. The agency now expects demand will increase by 5.5 million barrels per day (m/bpd) after falling by 8.8 m/bpd in 2020. With the matching supply figures being a recovery of 1 m/bpd after a fall of 6.6 m/bpd we could see some upward pressure.