Knight Frank Luxury Investment Index Q2 2017 Launches

Jewellery overtakes cars and wine powers ahead in Knight Frank Luxury Investment Index (KFLII)

3 minutes to read

Categories:

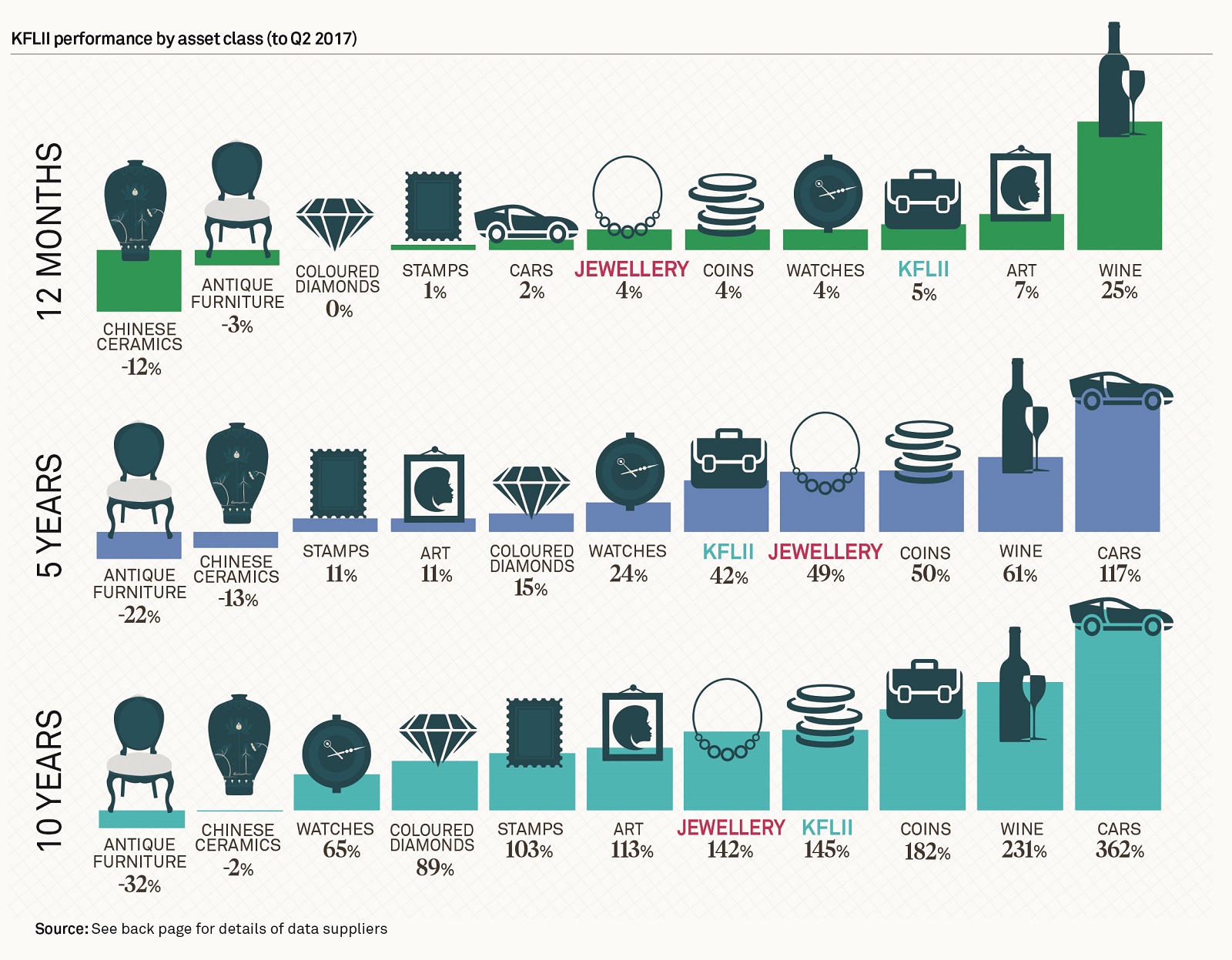

The Knight Frank Luxury Investment Index (KFLII) has risen in value by 5% over the 12 months to the end of Q2 2017, outperforming other safe-haven asset classes like gold and prime London residential property.

It is a time of change at the top of KFLII, which tracks the price growth of 10 luxury investment sectors. Classic cars, which have dominated the rankings for the past few years, have moved into sixth place with average prices rising by just 2% to Q2 2017. Wine, up 25%, was the top performer in the index thanks to strong growth in the key Bordeaux, Burgundy and northern Italian markets. No other asset class achieved double-digit growth across the past twelve months.

The latest edition of KFLII focuses on the performance of jewellery, which rose by 4% over the last 12 months. Overall, jewellery has risen in value by 142% over the past 10 years. While pearls are still the top performer (+282% across the last decade), their growth is starting to level out and more modern jewellery, especially pieces from the Belle Époque/Art Deco era, are starting to set the pace (+93% across the last decade).

It has also been a stellar year for coloured gems, with the world record being set for price per carat for a green gem when the 18.04-carat ‘Rockefeller’ emerald sold for $5.5million at auction. Blue stones continue to set the price growth benchmark for diamonds, rising by 5.5% over the past 12 months, compared with a slight drop in the value of pink diamonds, according to data from the Fancy Color Research Foundation (FCRF).

Andrew Shirley, who compiles KFLII, said:

“It has been an interesting year so far in the world of luxury investments, but one that is difficult to generalise about. While the most highly coveted objects of desire have performed strongly at auction, buyers remain circumspect when purchasing new assets for their collections.

In terms of classic cars, for example, we have recently seen the most expensive Aston Martin ($22.5m) and Mclaren F1 ($15.6m) go under the hammer, but other auction sales with less stellar cars have disappointed.

Jewellery continues to capture the imagination of wealthy collectors and is a genuine investment of passion – offering not only great pleasure to its owner, but also, as novelist Barbara Taylor Braford points out in the report, acting as a highly mobile store of wealth.”

Bonhams Global Chief Executive Matthew Girling commented,

“The Knight Frank Luxury Index provides a fascinating insight into the top areas of collecting. People will always seek out the best in class examples in their favourite collecting areas, and our own experience at Bonhams certainly bears out the report’s conclusions with wine, art, watches and jewellery all performing strongly over the past year.”

The report has an exclusive interview with international best-selling author Barbara Taylor Bradford OBE on her passion for jewellery and Susan Abeles, Head of Jewellery, Bonhams US, on how to start a jewellery collection and what’s hot at the moment.

To read the full report, click here.

Sources: AMR (Art, Watches, Antique furniture, Jewellery, Chinese Ceramics); Stanley Gibbons (Stamps, coins); HAGI (Classic cars); Wine Owners (Wine); Fancy Color Research Foundation (Coloured diamonds)

**KFLII is weighted based on the contribution of each component