Monthly UK Residential Property Market Update – December

Buyers and sellers shrug-off second lockdown.

4 minutes to read

A second national lockdown in England failed to slow the residential property sector’s momentum during November.

Unlike in the first lockdown in March, the property industry was granted permission to continue operating under Covid-safe procedures, this time from 5 November to 2 December.

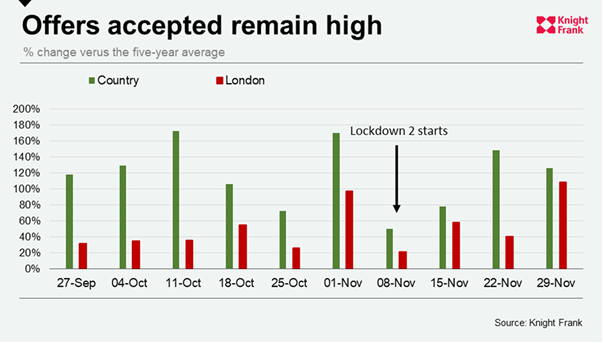

While there was an initial dip in new prospective buyers, new instructions to sell and offers accepted in early November, all measures rebounded quickly to resume their previous trajectory. As the below chart shows, the number of properties going under offer remains in excess of the five-year average, markedly so outside the capital.

Nationwide said annual house price growth accelerated from 5.8% in October to 6.5% in November, which was the highest figure since January 2015. House prices rose by 0.9% month-on-month in November, compared with 0.8% in October.

The lender said the stamp duty holiday along with the behavioural shifts among purchasers following the Covid-19 pandemic, would support housing market activity through into first quarter of 2021.

Meanwhile, Halifax said sales and new instructions remained above historic and seasonal norms in November. It reported that house prices had increased by 1.2% in the month, taking the annual change to 7.6%.

While prices are expected to continue increasing at a moderate pace over the next few months, surveyors responding to the November RICS Residential Market Survey believe sales activity may now have peaked. Near- term sales expectations have now become broadly neutral at a national level. The headline net balance slipped from +15% in October to -4% in the latest survey pointing to a levelling out in transactions over the coming three months.

Whatever the next few months bring, lenders continue to support activity with newly published data showing that the mortgage market accelerated in the third quarter, with the value of new mortgage commitments 6.8% higher than a year earlier at £78.9bn. This is despite a tightening in high LTV lending in recent months. Lending was at the highest level since the third quarter of 2007 and the global financial crisis.

There was a sharp rise in the number of new mortgages approved, from 98,300 in October to 105,000 in November. That left mortgage approvals at their highest since August 2007.

Prime London Sales

Price growth in prime outer London is outpacing central London in the final months of 2020 as demand for space and greenery remains strong after two national lockdowns.

Average prices increased 1.6% between June and November in outer London, which includes areas like Wandsworth, Belsize Park and Chiswick. Prices fell 0.1% over the same period in prime central London.

There was no notable impact on prices during the second national lockdown as there was during the first. Following quarterly declines of more than 3% in April and March, the decrease in the 12 months to November was 3.3% in POL and 4.3% in PCL.

Prime London Sales Report: November 2020

Prime London Lettings

Average rental values continued to fall in prime areas of the capital in the final quarter of 2020, pushed down by high levels of supply. However, activity levels remain well above the five-year average with many tenants moving due to a need for more space, while also taking advantage of lower rents.

The decline in average rents was 10.5% in prime central London in the year to November, while in prime outer London the fall was 9%. The declines have been less marked in south-west London, where supply has not built up to the same degree. In locations with a predominance of family houses, a strong sales market means the supply of rental properties has been kept in check.

Prime London Lettings Report: November 2020

Country Market

Despite the loss of eight weeks of trading during the first national lockdown, offers accepted in the country business were up 28.5% at the end of November versus the total number in 2019, underlying just how active the market has been since it reopened on 13 May.

Exchanges, which naturally lag accepted offers, were just 6.5% down at the end of November compared with 2019’s total. Just over a third of offers accepted have still not exchanged, suggesting activity will remain high during the next few months as agents manage the pipeline.

Demand remains strong too. In November, both the number of viewings in the Country market and prospective buyers registering with Knight Frank were up by 19.1% and 42% respectively, versus the five-year average.

Prime Country House Index Q3

The update is a live document but a monthly summary PDF is available via Siobhan Leahy on request.